#12: How much should founders pay themselves pre-revenue?

Ramen optional. Here’s a fair pay framework pre-revenue.

👋 Hey Diana here! Welcome to this Operations Optimist newsletter. Each week, I tackle questions about building operations functions in startups and share my lessons from working in venture capital! In today’s newsletter, we break down what is fair founder compensation pre-revenue.

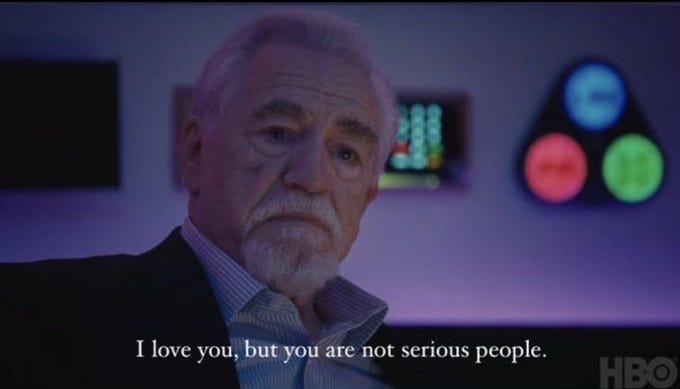

There’s a myth in early-stage startups that “real” founders don’t take salaries. That suffering equals legitimacy. That unless you're living on instant noodles, investors won’t take you seriously. It’s false. It’s outdated. And it ignores the reality that most people, even the most ambitious, still need to pay their mortgage.

The truth is: the line between underpaying yourself and sabotaging your own company is thinner than you think. Paying yourself too early, too much? Bad signal. Not paying yourself at all, indefinitely? Founder burnout in the making.

So what is fair compensation before your company makes a dime?

3 simple rules to pay yourself fairly (and not kill your startup)

In order to build a sustainable company, you need a compensation plan that doesn't punish ambition — or foster delusion.

#1 burn savings — briefly

If you're early and pre-everything (no revenue, no funding, no product), living off savings is fine. But it’s not a badge of honor if it lasts forever. Cap it at, say, 12 months.

Why this matters:

It shows conviction. You’re putting skin in the game.

But after a year, it becomes difficult to survive. You’re no longer being scrappy — you’re being reckless.

What to do:

Set a hard stop for when you’ll stop relying on savings (and what the trigger is—funding, traction, revenue).

Be honest about your runway. Not just for the business — but for yourself.

Communicate this plan with your co-founders so everyone’s expectations are aligned.

This isn’t about toughness. It’s about staying in the game long enough to succeed.

#2 underpay yourself — on purpose

Once you’ve been at it for around a year, raised a little capital, or have early revenue, it’s time to move from $0 to something. Aim for a salary that is just enough to cover your cost of living.

Why this works:

Keeps you focused, without triggering survival stress

Sends the right signal to investors: “We’re responsible, not desperate.”

Leaves more money in the business where it can do most good right now

How much is “just enough”?

Enough to cover monthly expenses, but probably not much higher than 70% of your market salary. Enough to live, not enough to coast.

If you're unsure, benchmark against other funded startups at similar stages (talk with other founders, use market data, e.g. Carta or Pave for compensation info)

#3 when revenue hits, raise your pay

When the business starts making money, congrats — you can now think in market salary category.

Why it’s okay:

Investors expect it. It’s baked into every sensible startup budget

Your job is now operational. You’re not “starting a company” — you’re running one

Nobody wants their CEO distracted by everyday payments

Just don’t overdo it

Be reasonable

Tie your comp to realistic company performance metrics or a board-approved range

Remember that equity upside is what makes founders rich — salary covers daily expenses.

And if you're raising money, bake your comp into your financial model. Nobody flinches when they see reasonable founder salaries on a $2M seed round. What does raise eyebrows? When the founders have no salary line at all. Unless you have made fuck-you money already, that signals either you’re hiding something or you’re about to crash and burn from financial stress. Neither is a good look.

That's it.

Here’s what we covered today:

Running on savings is a show of belief — not a long-term strategy.

Paying yourself below market is healthy, normal, and investor-approved.

After you’ve got recurring revenue, it’s time to take care of yourself — so you can take care of the company.

Bottom line: you can’t build a billion-dollar company if your fridge is empty.

Tell me what you thought of today's email.

PS. If you're enjoying Operations Optimist, consider referring this edition to a friend. Help them dodge the ramen trap — and build something that lasts.